WILLS & ESTATE PLANNING

Estate Planning

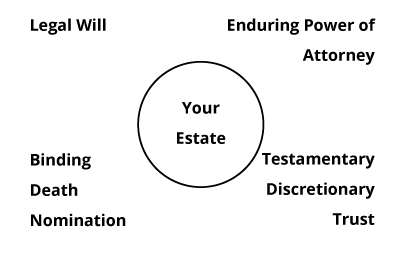

Our firm offers comprehensive and effective Estate Planning Packages which:

- are tailored to operate with your personal assets, trust and superannuation structures;

- implement effective mechanisms for the protection of your beneficiary’s interests from life’s stumbling blocks such as bankruptcy, divorce and tax implications;

- are implemented by our experienced Estate Planning Lawyers.

Outlined is a brief explanation of the services provided by our firm.

Legal Wills

Having a Legal Will ensures that your assets will be distributed to those family members and friends that you intend to benefit from your Estate. You can nominate a trustee to administer your Estate, a Guardian to take care of your infant children, and ensure that your assets pass to your loved ones upon your death.

If you pass away without a Legal Will in place then your Estate will be distributed according to the provisions set forth in the Succession Act and this can normally result in an unwanted outcome where your assets and wealth are distributed against your wishes. Further, your Estate will likely to incur further administration costs, tax implications with higher risk of the matter being litigated in Court.

The first step inestablishing an Estate Plan begins with establishing your Legal Will. A valid Will gives structure to your estate, allocates benefits from your personal estate as well as who is to administer the estate.

A common mistake in Estate Planning is assuming that a Will covers all the assets and wealth that you may have access to including such items as Superannuation. This why a comprehensive Estate Plan is strongly recommended for those who have investment

Binding Death Nomination

A Binding Death Nomination is in a sense a Will for your Self Managed Superannuation Fund (SMSF). As your SMSF does not technically form part of your Personal Estate (as you are a beneficiary of your SMSF), your Will has no bearing on how SMSF assets and wealth are distributed. It is vital that all SMSF’s have a Binding Death Nomination drawn up to avoid any unwanted distribution of wealth.

Enduring Power of Attorney

An enduring Power of Attorney is a specific Power of Attorney (POA) document that is activated when you loose the ability to be able to make legal decisions on your own (i.e, if you are incapacitated or suffer from dementia or Alzheimer’s) and nominates a trusted Attorney (oftenyour spouse) with specific powers to make decisions in relation to your financial and health matters. If you are to become incapacitated and you don’t have a POA in place then your family members will need to apply to a tribunal to appoint an Attorney which can be costly and ultimately against your wishes.

Testamentary Discretionary Trust

A Testamentary Discretionary Trust (TDT), sometimes referred to as a “Will Trust” is a flexible structure and can be designed to operate effectively in most scenarios. Some of the advantages of a TDT are:

Flexibility for Beneficiaries

(avoiding the Ferrari factor)

- A TDT provides a mechanism for protecting inheritances from the beneficiaries themselves. If a beneficiary has uncontrolled access to an inheritance those funds might be used for purposes other than what you intend.

- The Trustee of your TDT will have discretion to distribute capital and income from your Estate to any nominated beneficiary at any time and in defined or discretionary proportions.

- The TDT can be wound up at any time or kept open for an extended period of time, so the distribution of your Estate can continue until a beneficiary reaches a particular age or over an extended period of time.

Capital and income Allocation

- With a TDT’s optimum allocation of income and capital, beneficiaries may still be permitted to qualify for government pensions or benefits, such as aged, disability and sole parent pensions, which they otherwise would not have to access under a standard inheritance.

Asset Protection

- Assets are not legally owned by the beneficiaries, and so there is a greater level of protection from any legal proceedings (most commonly the Family Law Courts and Bankruptcy).

- A TDT legally separates the inherited assets from the personal assets of the beneficiaries, so the inheritance is protected.

Taxation Benefits

- Taxable income generated by the TDT can be allocated to the beneficiaries of the trust in a tax-effective manner. The beneficiaries pay income tax on their share of income according to their marginal tax rates.

- By sharing the income from the investment of the Trust capital with other beneficiaries, this minimises the income tax on this income.

- Infant beneficiaries would be entitled to the normal tax free threshold, and would thereafter be assessable at the lowest income tax rate.

Default Vesting of Inheritances

- There are default provisions in a TDT whereby if the TDT cannot come into effect or fails for some reason, the Trust income and capital will vest in the intended beneficiaries anyway.

- A TDT therefore provides a greater degree of certainty as to how your estate is to be distributed in the unlikely event that the TDT does not come into effect or fails.

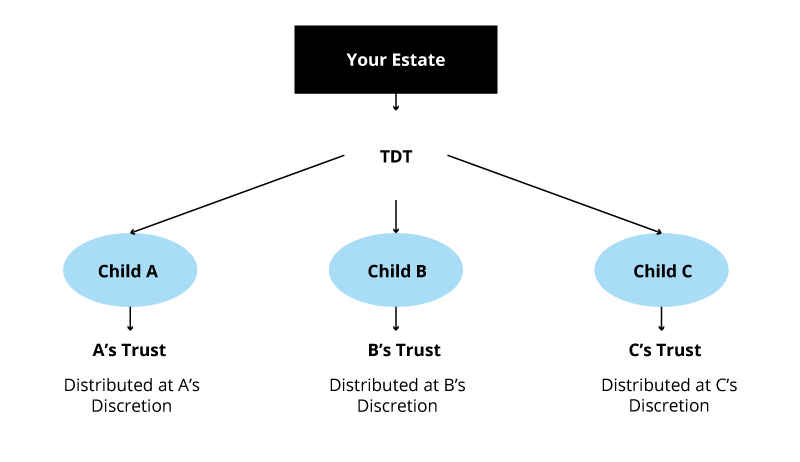

Testamentary Discretionary Trust (TDT) Example

Let’s say that you have three children A, B and C and they are all of age and look after their own affairs. Three Trusts or separate funds would be created. A would be the Trustee (or controller) of his/her Trust and each of the other children would also control their Trust.

- The potential beneficiaries of A’s Trust would typically be A, A’s spouse, A’s children, A’s grandchildren and their spouses.

- The Will would provide that the capital of A’s Trust is to be held on trust for one or more of those beneficiaries as the Trustee (A) decides, and that the Trustee can make that decision at any time within 80 years after the Willmaker’s death. Accordingly A has access to the capital at any time if he/she wants it to become his/her absolute property.

- While the capital remains in the Trust, the Trustee would normally invest it or apply it for the benefit of one or more of the beneficiaries. The Will would provide that the Trustee has the absolute discretion either to accumulate the income from any investment within the Trust or to pay that income to any one or more of the potential beneficiaries, again as the Trustee decides in his / her own absolute discretion.

Estate Planning Packages

Basic Estate Package

Legal Wills

Enduring Power of Attorney

Binding Death Nomination

)

Total Cost: $3,300 inc. GST

Complete Estate Package

Legal Wills

Enduring Power of Attorney

Binding Death Nomination

Testamentary Discretionary Trust (TDT)

Total Cost: $6,600 inc. GST

NATIONALLY ADMITTED